Managing profit and loss is all about managing the relationship between costs, volume and pricing. Break-even is a tool that can help business owners and managers gauge the results of future changes to costs (expenses) or pricing.

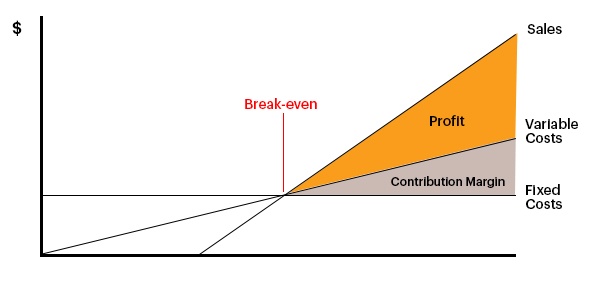

A break-even analysis focuses on two types of costs - fixed costs and variable costs - and how changes in either affect profits. By using the break-even tool, we can map changes to costs and/or pricing to the corresponding changes that are required in sales volume if a given level of profit is to be maintained.

Why is the simple calculation of break-even so important?

Used correctly, a break-even analysis can:

- Lead to better pricing strategies

- Demonstrate the full impact of discounting and what it really costs you

- Improve variance analysis and your ability to manage risk

Sounds like the silver bullet that all business owners need, so why aren't more businesses taking the time to use it correctly?

In our experience up to 75% of business owners do not know their break-even point in terms of sales dollars or volume. Those that claim to know their break-even point, often have an incorrect estimate and are not using it to maximum effect.

What affects breakeven?

- Contribution margin

- Costs - distinguished between fixed and variable

An initial hurdle is often the assessment of Fixed Costs versus Variable Costs. Fixed Costs happen whether you sell something or not (e.g. rent). Variable Costs are directly related to producing a product or delivering a service (e.g. packaging, sales commissions), so as sales increase so do variable costs.

An initial hurdle is often the assessment of Fixed Costs versus Variable Costs. Fixed Costs happen whether you sell something or not (e.g. rent). Variable Costs are directly related to producing a product or delivering a service (e.g. packaging, sales commissions), so as sales increase so do variable costs.

Read blog: How Different Pricing Strategies Can Impact Your Business

Calculating break-even

- First you need to work out your contribution margin. This is the margin or percentage of sales left to cover all your fixed costs, once all the variable costs are paid.

- From here you apply the contribution margin to your fixed costs to assess the breakeven point. This can be expressed in either sales dollars or sales volume.

|

Ratio |

How to calculate |

|

Contribution Margin |

1 - (variable costs / sales) x 100 |

|

Break-even Sales |

(fixed costs / contribution margin) |

|

Break-even Gap |

sales - break-even sales |

|

Break-even to Achieve Profit |

(fixed costs + target profit) / contribution margin |

Case study: How to do a break-even analysis

Clients often come to us with plans for expansion, enter into a new market, or purchase/start a new venture. The outline below represents a useful way to initially evaluate the sales volume necessary to cover costs, including target (or required) profits.

Let's assume that you have three stores and you plan to open a fourth. By doing a little financial analysis, you find that your cost structure is as follows:

|

Fixed Cost |

$250,000 |

|

Variable Cost % |

60% (as a percentage of sales) |

|

Your Planned Investment |

$1,000,000 |

|

Your Target ROI |

20% |

|

Target Profit on your Investment |

$200,000 (20% of $1,000,000) |

Here are the calculations:

|

Ratio |

How to calculate |

|

Contribution Margin |

1-(0.6) x 100 |

|

Break-even to Achieve Profit |

(250,000 + 200,000) / 0.4 |

So you need sales of $1,125,000 from your new store to cover your fixed costs and provide your target profit return of $200,000.

No break-even analysis is complete without a market analysis to help forecast the sales you will likely get. You can then compare what you will get (market analysis), with what you need (break-even analysis).

If what you will get is greater than what you need, then the fourth store is a good option. If what you will get works out to be less than what you need, then it is back to the drawing board.

Some break-even analysis points to remember

As a result of completing countless break-even assessments, we have learnt some lessons along the way, so here are the key points to remember;

- Always think in terms of gross contribution (not sales)

- Gross contribution is the only income of the business

- Gross contribution can be increased by increasing price and/or reducing direct costs

- Always consider the magnified effect of a small discount or a small price increase on gross contribution.

- Avoid discounting—who wants to be a busy fool. Instead, consider adding more value and/or a price increase.

- Break-even and your cost structure will have ramifications on your product/service mix, how you manage staff remuneration and incentives, and resource allocation decisions.

This blog was written by Mike Atkinson from Bellingham Wallace, a Chartered Accountancy firm based in Auckland. Since 2013, The Icehouse has worked with Bellingham Wallace to provide financial management capability workshops for business owners and leaders.