Choosing to discount, lower or raise prices is going to create a ripple effect that will impact other areas of your business. But how and to what extent?

Impact of a Discount Pricing Strategy

When competition gets tough it's tempting to resort to short-term discounting, but this can cause huge cash flow problems for a business. Pricing problems can also be a symptom of other weaknesses.

Inevitably, discounting is a short-term solution with a long-term impact which has the potential to devastate profits. However, it is important to consider discounting as a tool to manage your stock and in turn, your working capital.

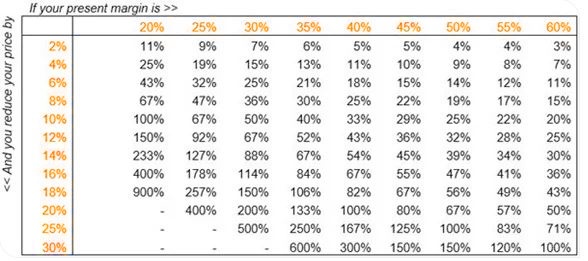

The table below outlines how much more you'll need to increase your sales in order to make the same amount of money, based on various Gross Profit Margins and discounts. Food for thought! Hopefully your accountant has used a similar model to explain the effects of discounting on your business.

Given a price reduction, to achieve the same profit your sales volume must increase by:

For example, at a 40% margin, a 10% decrease in price would require sales volume to increase by 33% to maintain the same level of profit. Ouch!

Many businesses will have a business development manager or sales team. Typically their performance is linked to how much they sell. Unfortunately some sales teams will resort too quickly to discounting as a tool to secure a sale, without realising the larger impact. Educating your sales team on the true impact of discounting is therefore paramount. Alternatively, you may want to think about restructuring performance incentives around gross profit instead of top-line revenue - this is something we have done for several of our clients.

Read more: What Does a Strong Balance Sheet Look Like and Why Is It Important?

Impact of Premium Pricing Strategies

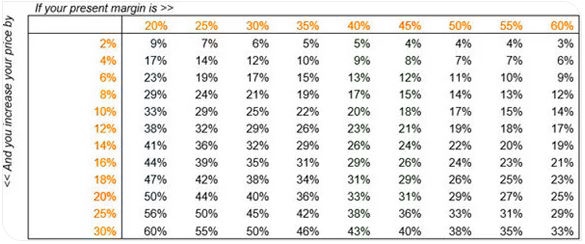

Raising your prices will have the opposite effect. Based on various Gross Profit Margins, the table below shows what happens to sales volumes when a premium pricing strategy is introduced.

Given a price increase, your sales could decline by the amount shown below before gross profit is reduced:

For example, at a 40% margin, a 10% increase in price could sustain a 20% reduction in sales volume.

If you are considering your pricing strategy, start by determining if your business and the individual product lines it offers compete on:

- Price: This would direct a "lower price, lower margin, higher volume" approach, or

- Differentiation: i.e. be the product leader. This would allow you to support a "higher price, higher margin, lower volume" approach, at least until your competitors start stocking the same product, or

- Customer Experience: i.e. service, customisation, larger variation in product assortment. This would help sustain a "higher price, higher margin, lower volume" approach. It's okay to be priced higher than your competitors, as long as you meet your customers' expectations of quality and value.

The general rule of thumb is that you need to match the market in two of the above factos and beat the market in one. There are obviously many other factors relating to personal circumstance that need to be taken to account.

This blog was written by Mike Atkinson from Bellingham Wallace, a Chartered Accountancy firm based in Auckland. The Icehouse has worked with Bellingham Wallace since 2013 to provide financial management capability workshops for business owners and leaders.