University of Virginia Darden professor Saras Sarasvathy’s groundbreaking 2001 paper “What Makes Entrepreneurs Entrepreneurial” finally gained some widespread recognition when Vinod Khosla posted a copy on his website with some personal notes, one of which read: “First good paper I’ve seen”.

Professor Sarasvathy developed the Effectuation theory of entrepreneurship after exhaustively interviewing 27 serial entrepreneurs. Her research findings greatly advanced the answer to the age-old-question – What do entrepreneurs actually do? (thus defining the process of entrepreneurship, which everyone seems to viscerally believe it is different from management).

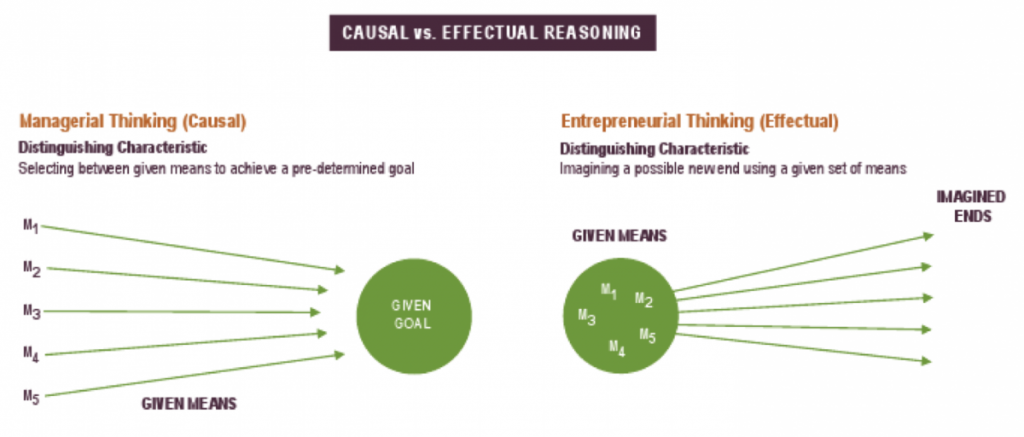

Effectuation is generally defined as a form of reasoning or problem solving which assumes the future is largely unpredictable, but that it can be controlled through human action. This is in stark contrast to another form of reasoning, Causality, which assumes the future is theoretically predictable based on prior events.

Sarasvathy argues casual thinkers start with an End in mind and try to find the best Means to achieve it – They follow the adage “”If I can predict the future, I can control it.”

Sarasvathy observed that most managers are Causal thinkers, but not entrepreneurs (for the most part). She observed that entrepreneurs are indeed Effectual thinkers who start with a given set of Means and find new and different Ends, which are not necessarily pre-determined. Entrepreneurs in her studies follow the adage “If I can control the future, I do not need to predict it”.

Professor Sarasvathy meticulously researched and proved what a lot of us have felt at heart – Entrepreneurs make it up as they go along – and that this process can be learned! This is refreshing as previous theories of entrepreneurship weren’t exactly inclusive or practical, emphasizing ‘special’, risk-taking traits that only some people would innately possess or theoretical market imbalances and radical technologies that created opportunities for disruption (that most of us wouldn’t be able to recognize, much less base our plans for world domination).

For a personal example, here’s a video link [now removed] to a Churchill Club fireside chat with IDEO’s Dave Blakely of how I started Qualcomm’s employee innovation program a few years ago- public admission of Effectuation, not Visionary skills.

The brilliant principles of effectuation

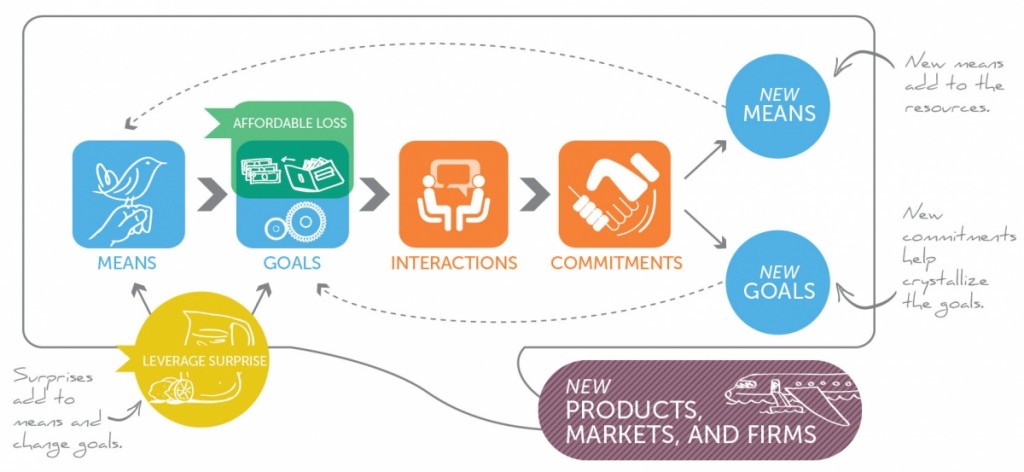

The theory of effectuation boils down to the observation that when it comes to Entrepreneurship, Effect trumps the Casual view of the world (that the future is neither found nor predicted, but made – so focus on what you can control). The theory of effectuation is further complemented by four basic principles derived from Professor Saravathy’s original study:

Bird in Hand Principle – Start with your means

Entrepreneurs start with what they have: Who they are, what they know and who they know – For example, if a cook were to act entrepreneurially, he or she would concoct an unknown dish with whatever ingredients were available in the kitchen pantry, not follow a known recipe (nor necessarily a vision). The bird in hand principle or “making do with resources at hand” was first introduced by Levi-Strauss in 1967 specifically in the context of Arts, Crafts and Science and has since been carried to the field of entrepreneurship by a slew of other scholars and practitioners. This principle essentially says ‘Just Start!’, instead of waiting for the perfect conditions to arrive (which is not the same as advising to ‘Just Do It!’, meaning to faithfully following your gut towards an inflexible end goal without a care for proof along the way).

Affordable Loss Principle – Set affordable loss

Traditional analysis of markets start with estimating the upside, the proverbial market sizing exercise (TAM, SAM, SOM, bla, bla). But entrepreneurs usually pursue unknown markets. Clayton Christensen said it best “unknown markets cannot be analyzed”. Turns out entrepreneurs are more concerned with analyzing the down-side of their actions to manage their risk, which can often be accurately calculated – If they can afford the cost (of an experiment), they jump into the venture and if they can’t, they choose something else they can afford. This is also the basis for the VC industry (staged risk), although they still make prospective portfolio companies provide ridiculous spreadsheet projections, maybe so they can have a good laugh when people leave the room – those masochists!

Lemonade Principle – Leverage contingencies

The Lemonade Principle is my favorite (I know, I don’t get out enough if I have favorite principles from a relatively obscure theory). Obviously inspired by the aphorism “If life deals you lemons, make lemonade” (I presume life also gives you the sugar, but I digress), this principle basically states that entrepreneurs must be flexible above all else, not recalcitrant – that entrepreneurs must expect to exploit the unexpected, not existing knowledge.

The way this principle is stated also emphasizes the upside of being flexible or open to change, not simply the notion that flexibility is primarily designed to avoid failure – flexibility is also the best way to fight complacency – to constantly seek something better (play offense, not simply defense). The Lean Startup movement has unfortunately taken on the meaning of an effective philosophy to ‘avoid failure’ – “When are things going so wrong that one needs to pivot?” – Is often the question asked vs. “How do we know when we’ve exhausted the upside of this beautiful thing called a strategic pivot and should finally focus on the current direction?”. Innovation in general, for that matter, is usually brought about in a negative, “innovate or die” dictum vs. “Who cares about your eroding competitive advantages or threat of disruption – The world needs additional sources of human happiness – so please get out there an innovate more!”

Crazy-Quilt Principle – Form partnerships

I have no idea why this principle is called the crazy-quilt principle, but it sounds pretty cool. This principle basically encourages entrepreneurs to be networking machines – period. You never know what may come of talking to customers, experts and other companies – a much better use of time than insipid market research or planning exercises based on competitive paranoia (as a startup, you’re an ant – you have no competitors). Partnerships can fuel a given business model design as well as provide inspiration for a new business model altogether (they can create new means to new ends). Partnerships (and key commitments, of course) can also provide the missing proof of business-model scalability that gains the confidence of investors. Market making, industry-control issues are certainly important in the growth of a startup (so careful with partnering terms), but avoiding contact in the early stages has never been proven as a formula for toughness and resilience. Just like in international affairs, alliances trump isolationism (sorry North Korea).

Summary

- Effectuation is a valuable theory based on solid field research to explain what entrepreneurs actually do

- It complements other theories of entrepreneurship such as Lean Startups and Bricolage that recognize the uncertainty of venturing into unknown markets vs. the certainty of executing in known markets

- In its advice on how we can reduce uncertainty, Effectuation is practical, sensible, inspiring and inclusive – Just start with what you have, risk what you can afford, be open to pleasant surprises, and seek relationships with others

You can read more on Effectuation on the movement’s website: www.effectuation.org and thank you Dr. Sarasvathy!

Written by Ricardo dos Santos